Buying Silver Coins

When you're buying silver coins your first concern should always be return on investment. Whether you buy coins for their bullion value or their collectible (numismatic) value at the end of the day it would be nice to make a profit.

Buying for Collectable (Numismatic) Value

When I was a kid I was a coin collector. My friends and I would get together from time to time and spend hours looking over our coins. So, I know what pleasure there is to be had from coin collecting.

The numismatic value (as opposed to the bullion value) of a coin is based on scarcity, wear, quality of appearance and sometimes interest. A rare collectible silver coin are often attractive and can sometimes be sold for a nice profit. The numismatic value can be different depending on the valuation method and it can be quite subjective. Rare collectable coins are like art in that they are only worth what someone will pay for them.

There are many grades of numismatic valuation but really only two very desirable categories - uncirculated and proof. An uncirculated coin is simply one that has not been put into general circulation and therefore is pretty much in the same condition as when it was first minted.

A proof coin is one that has been struck using a special minting process. In the process the coin gets struck more than once. This causes the coin to be very shiny and shows a very high level of detail. A proof coin is usually uncirculated as well. All things being equal, proof coins are more highly valued than merely uncirculated coins. They are very pretty coins.

Buying for Bullion Value

Buying silver coins for their bullion value is much different than buying them for their numismatic value. The bullion value of a coin depends upon the purity of silver and weight of the coin. Many coins are minted to include exactly one ounce of silver. This is very convenient for the investor - no evaluation process needed.

Bullion coins minted by governments, like American Silver Eagles, cost more than privately minted coins (silver rounds). The "premium" on the bullion coins minted by governments can be as high as a few dollars per coin. This is because American Silver Eagles are well-recognized and people trust that the silver in them is actually one ounce. Some, if not all, of this premium can be gotten back when you sell.

Related articles:

- Why buy silver? - In this article we give a number of reasons to buys silver.

- United States Mint - My wife and I visit the US Mint.

- Silver Coin Value and Beliefs - See how much of a part belief plays in the value of your silver.

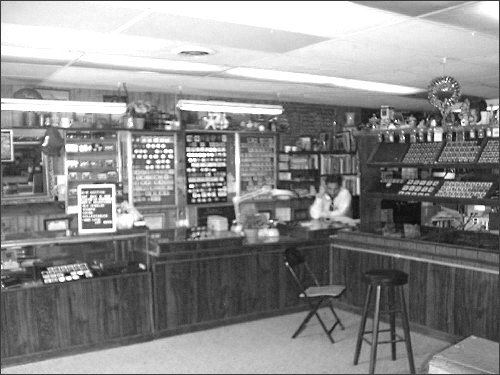

Coin Dealer in Waretown NJ

Coin Dealer in Waretown NJ

It is my opinion, at this time, that if you are going to buy coins for their bullion value you should first buy the most recognizable and trusted coins. Government minted coins seem to be appropriate for this. The reason for this is that you could easily sell these in an emergency. After you obtain some reasonable quantity of these easily recognizable government minted coins you may want to buy privately minted silver rounds because you get slightly more silver for your money.

It is also my opinion that a person should buy the coins minted by their own government - if trusted. For instance, if you live in the U.S. buy American Silver Eagles from the US Mint. If you live in Canada buy the Canadian Silver Maple Leaf from the Royal Canadian Mint. If you live in Australia, buy the Australian Silver Kookaburra from the Perth Mint. If you live in the UK you might try the British Silver Britannia from the Royal Mint. Anyway, you get the idea. Keep it local if possible.

Summary

When buying silver coins return on investment should be a concern. I have bought coins for their numismatic value and I have bought coins for their bullion value. Coins valued for their bullion are much easier to sell than rare coins valued for their numismatic value because there are more potential buyers. Which ever investment you choose get yourself well-educated and always have a plan to sell BEFORE you buy.